Is Singapore a good place to start a business?

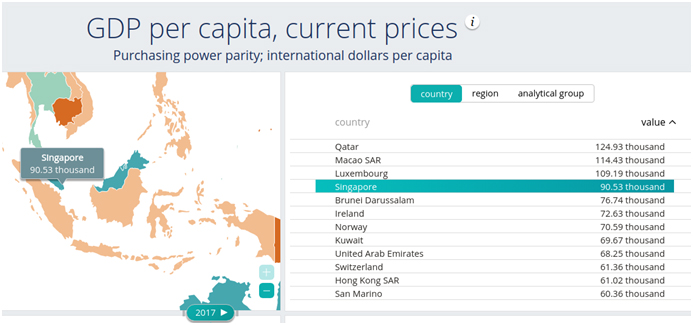

Today, Singapore ranks as the 4th highest GDP in the world. The nation is known as an economic powerhouse not just in South-East Asia, but the world too. This nation attracts large corporations and MNCs to operate their businesses from here. Singapore is a trading hub of the world, and many corporations cannot afford to not have a branch in the nation.

However if you are planning to start a business – Is Singapore the right place for you? While Singapore may be a vital city for many large corporations, how does it fare for smaller businesses? Is Singapore a good place to start your business? Is Singapore the best place to do business? These are just some of the many questions tackle in this post.

To answer these questions, we need to lay down parameters and judge the city-nation based on that.

Strategic Location

By far, Singapore’s biggest advantage is its location. Not only is it a port city, but it is also located in a very strategic location. Singapore is a gateway to South-Asian countries. If a crucial aspect of your business is transferring goods throughout the world, or you are a logistics company, you can reap the full benefits of Singapore’s location. The Port of Singapore is the world’s third busiest port in terms of shipping tonnage.

In addition to accessing the shipping lanes, Singapore is also well-connect by air. Cargo and transport airlines are connecting to all the major cities in the world.

Quality Infrastructure

Infrastructure not only impacts how a business functions but also impacts the quality of life for yourself and employees. Mercer, a consulting firm, ranked Singapore 25h the Quality of Life index and gave it rank 1 for city infrastructure. This was a ranking made in consideration of the city’s electricity, drinking water, telephone and mail services, and public transportation.

Singapore also spends a large amount on infrastructure. In 2017, the government budget allocated $700 million for infrastructure.

Free Trade Agreements

If your business is based in Singapore, you want to be able to tap into other international markets easily. Singapore has signed many trade agreements with countries in the neighbourhood which allow you to do that. The nation has signed 20 FTAs with 31 trading partners.

This opens other countries’ markets to businesses based in Singapore, eliminates import duty tax, and streamlines sales and excise tax. Singapore has signed FTAs with ASEAN countries, India, China, Australia, Turkey, United States, Japan, Korea, and New Zealand. Just to name a few. Your business is able to access these markets at ease.

Funding

For your business to grow, you need to access sufficient cash flow, and that often comes in the form of funding. Singapore is home to some of the largest banks in Asia such as DBS Bank and United Overseas Bank. Additionally, the government offers many grants to rising businesses like Action Community for Entrepreneurship Scheme, Capability Development Grant, Early Stage Venture Funding and more.

Additionally, Singapore attracts plenty of Foreign Direct Investment. In 2015, Singapore’s received an FDI of $1,255,542 million.

And, over the years, the FDI in Singapore has been frequently increasing. Singapore is an investment-friendly company, which ensures the world’s biggest venture capitalists are present in the nation.

As a business operating in Singapore, there will be no dearth of opportunities to gain financial investment.

Singapore as a Headquarter

Due to Singapore’s unique geographic location, your business automatically enters a networked economy that stretches across the world. Taking advantage of this, the government of Singapore offers businesses many advantages if they are headquarter in the nation.

The Economic Development Board has many fruitful benefits to businesses that set up their International Headquarters or Regional Headquarters in Singapore. Businesses with a regional headquarters status are given a 15% concessionary tax rate for qualifying income generate from the branch. Businesses with international headquarters status are offering customise concessionary tax rate which varies from 5% to 10%.

An additional benefit, for Singapore-based business, is that they can return dividends to directly-held foreign subsidiaries free of Singapore tax.

Singapore’s Tax System

Singapore has built a tax system that aims to ease the effort of operating a business, while not significantly eating into the business profit. Singapore has a territorial taxation system, which allows only Singapore source income to be tax. Income generate from your foreign business branches can be subject to tax exemption.

Furthermore, Singapore’s tax rate is set at 17% and follows a single-tier corporate tax system.

Ease of Doing Business

The ease of doing business is calculating on a number of parameters such as:

- Registering a business

- Acquiring Permits

- Getting Credit

- Paying Taxes

- Trading with other markets

The World Bank has globally ranked Singapore Number 2 in ease of doing business.

The World Bank’s Report Card on Singapore

All of these points bring us back to the questions of – Is Singapore a good place to start a business? Is Singapore the best place to do business?

Singapore may be a small nation, but through good economic policies and governance, the country has made itself into an economic and business powerhouse. The country has actively taken, and continues to take steps, to ensure that it is one of the best places in the world to start a business.

Best Moneylender Reviews is not a money lender in Singapore. But we are first rated moneylender’s forum. Our website is enable people to sharing experience with money lending in Singapore.